Small Business Loans In The Yellowhead East Region

Great loan options from great people.

Get the financial support you need to grow your business with one of our flexible business loans. We’re known for saying ‘yes’ when everyone else says ‘no’. If you can’t get a loan from traditional banks, we can help.

Our business loans range up to $150,000 and include:

- Loans for starting a business

- Business expansion loans

- Technology investment loans

- New business loans

- Buying an existing business

With Community Futures, you borrow only what you need, when you need it.

Many of our clients start with one kind of loan product and over the years take advantage of our other great loans and programs.

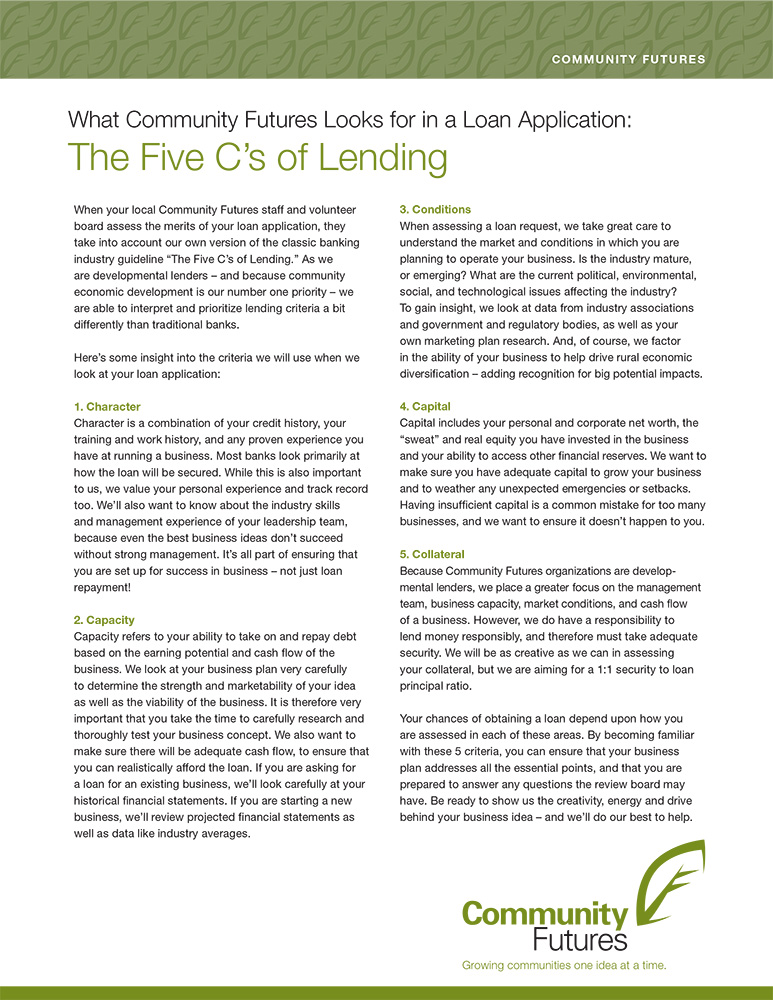

Loan qualification and repayment terms are affordable and flexible. We take a broader view of your assets, income, and skills than traditional lenders such as banks.

Get access to a wide range of business support from business advisors who know rural business like no one else, including free business guidance and counselling.

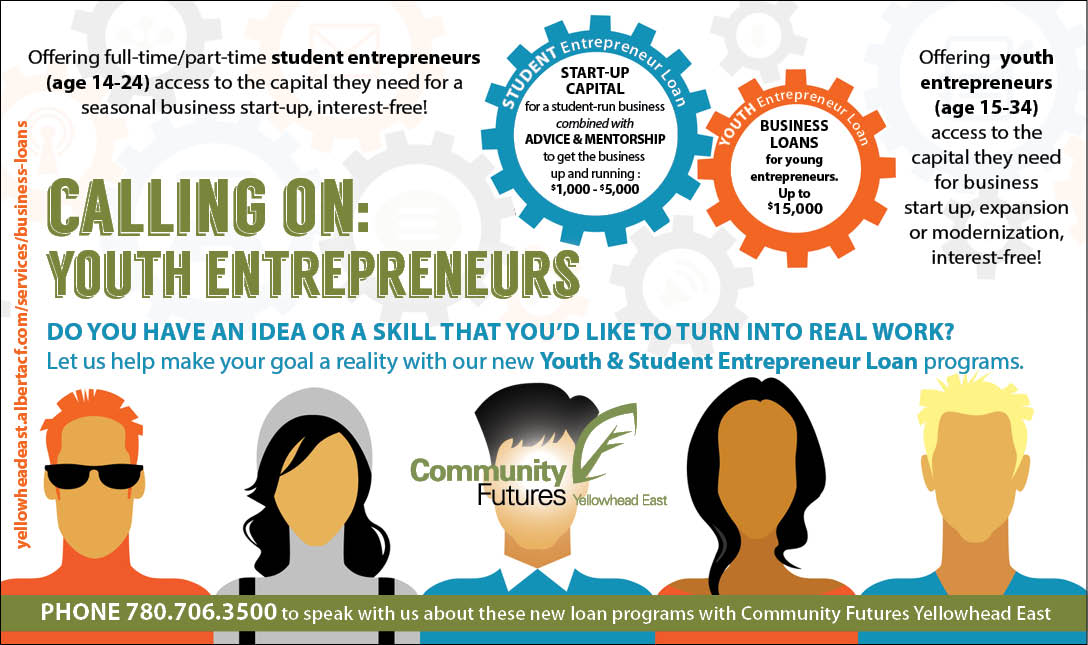

Community Futures Loan Products - Something For Everyone

Rural businesses in Alberta relied on support from Community Futures through the COVID-19 pandemic

LOAN DECISION APPEAL PROCESS

Community Futures Yellowhead East is an independent not-for-profit corporation led by a Board of Directors. The local Board of Directors has final authority for all decisions.

In an effort to safeguard all efforts are made to ensure clients are served in a fair and professional manner, the Board of Directors will ensure the Corporation provides clients with access to an appeal process.

In addition, where a client requests an independent review of the Board’s original and subsequent appeal process, the Board of Directors will ensure the Corporation provides the client with timely access to a process of external appeal provided in Alberta through the Northwest Alberta Community Futures Region’s Appeal/Redress Committee.

The role of the Northwest Alberta Community Futures Region’s Appeal/Redress Committee is to provide an external and independent review of Community Futures Yellowhead East’s decision making and internal review processes. The Board of Community Futures Yellowhead East maintains all final authority for all decisions.

Business Loan FAQs

The best place to start is to schedule an appointment with one of our Business Analysts.

General eligibility criteria include:

- Your business must be located in a rural community of Alberta

- You must be involved in the day-to-day operations of the business

- You must be of legal age and a resident of Canada

- You must contact a bank first. If you are unable to secure appropriate financing under reasonable terms elsewhere, contact us.